NFT or non-fungible tokens refer to unique assets, like an irreplaceable doge meme or an autographed tweet. NFTs could be anything from an art piece, domain name, a tweet, music piece, a trading card or just about any digital good that has a value attached to it.

While NFTs have been around since 2014, their popularity is fast gaining momentum as the new-age way to buy and sell digital artwork. In fact, since 2017, over $174 million have been spent on NFTs. Managing NFTs is similar to managing cryptocurrencies and may be done by mobile or online app. It’s possible to accomplish this on a smartphone using cryptocurrency exchanges.

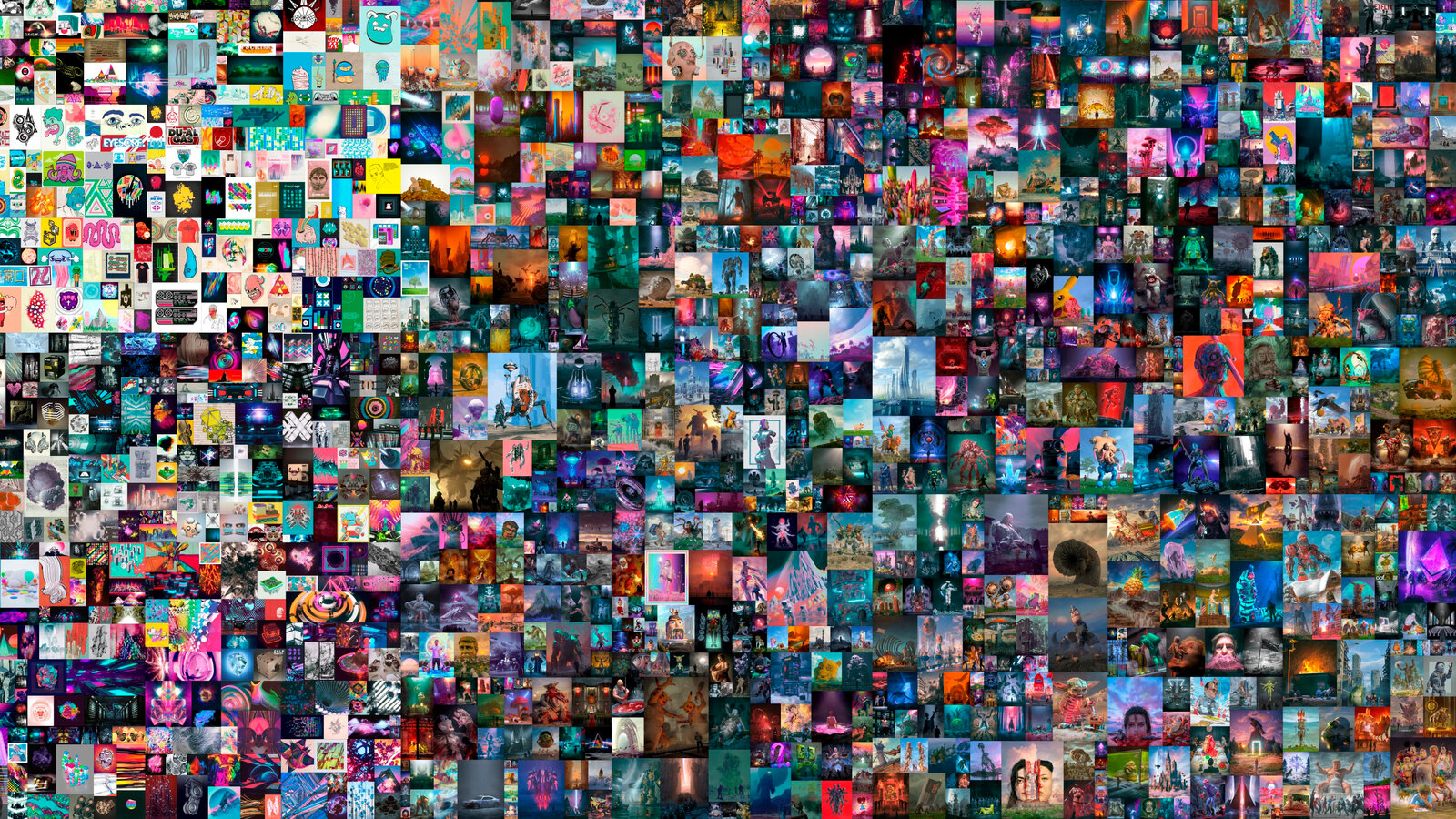

Powered by blockchain technology, NFTs are encoded and sold online, frequently in exchange for crypto coins. Usually found on the Ethereum blockchain, these digital assets stored in digital ledgers hold more information that makes them work differently than an ETH coin. NFTs are developed from digital assets, tangible and intangible items that can vary from art, GIFs, videos, collectibles, avatars, video game skins, music, tweets, and designer shoes. NFTs benefit artists and content creators alike. They offer an opportunity to monetize their art without relying on galleries or auction houses. Instead, NFTs can be directly sold to the customer, allowing them to earn and retain most of the profit for themselves. The sale can even be structured to earn royalties if their art is resold, a privilege they wouldn’t be offered otherwise. Investing in NFTs is a great way to make money. But like any other investment, it has its share of risks as well which ACME Dividends covers and protects investors from.